Agricultural firm Sasini is now setting eyes on new investments as it seeks to grow its revenue and stay within the elite club of firms with annual net profits above Sh1 billion.

The firm, whose main segments of business include tea, coffee, and macadamia, says that it wants to build on the Sh1.17 billion net profit it posted in the financial year that ended September 2022 by deepening its investments.

Sasini managing director Martin Ochieng’ says the expansion plans are part of the reasons the board opted to keep dividends unchanged at Sh1 per share despite the doubling of profits from Sh573.2 million.

“We have to continue growing. We have to be careful that we are not too ambitious. We have to be realistic. We see growth. We hate it when things diminish,” said Mr Ochieng’.

Mr Ochieng’ says the firm wants to expand, possibly into new crops or other businesses related to agriculture and also get into new markets.

“For us to expand into new markets, we need more funds and more produce. We need to invest in new estates and find new crops that we are currently not doing so that we can send to these markets,” said Mr Ochieng’.

The agricultural firm is currently serving markets such as Pakistan, Korea and Japan but now wants to deepen inroads in the Asian market on the back of the growing middle class.

The strategy, according to Mr Ochieng’, will be to strengthen their presence in the current markets and expand to those the firm is not serving currently.

“We are not yet in India and China yet they have a very strong growing middle class that can afford the products that we produce.

If we open up to new markets it means we need to have enough produce to satisfy these markets,” said Mr Ochieng.

Sasini has several options at the table including launching new products or new service lines or looking for acquisitions or joint ventures.

“The holding of cash as opposed to increasing dividends is linked to this because we think some of these opportunities will materialise this year in which case we will need cash to transact,” he said.

The expansion to new crops looks set to help Sasini build on the gains that were made when it launched the macadamia and avocado business. The two lines of business helped it to lower the concentration risk on tea and coffee.

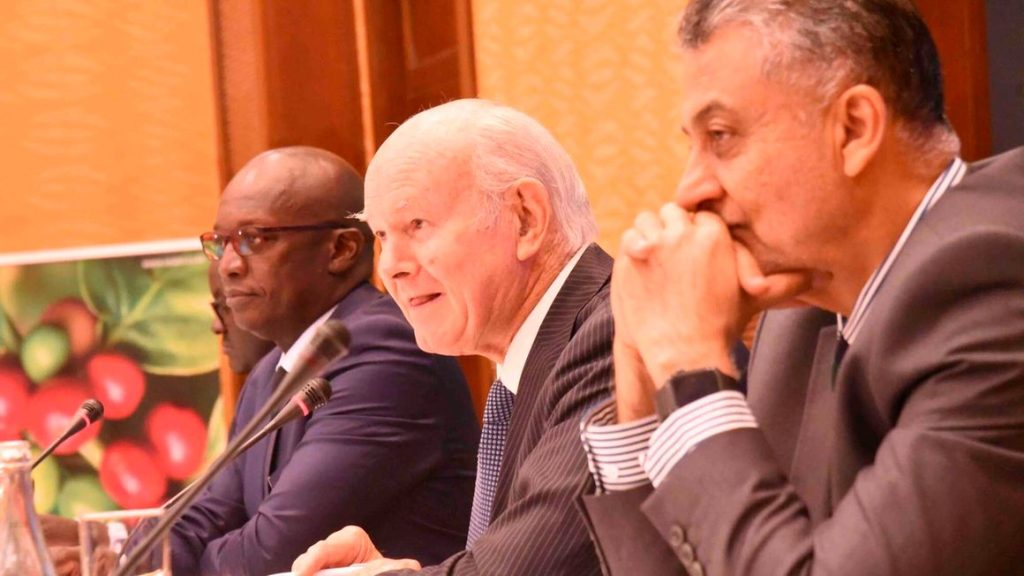

Sasini PLC Group Managing Director Martin Ochieng’ (left) with chairman Dr James McFie (center) and director Akif Butt during the Sasini Plc investor briefing at the Nairobi Serena Hotel on January 26, 2023. PHOTO | DIANA NGILA | NMG

The macadamia and avocado business contributed nearly a third of the Sh1.2 billion net profit, showing the potential of the two crops in lowering the contribution of coffee and tea in total revenue below the current 83 percent.

Sasini will this year have to defy challenges such as the continuing Russia-Ukraine war, China’s extensive lockdowns, drought and rising inflation to keep its performance up.

Chairman at Sasini, Dr James McFie, said the prevailing environment added to the challenges in key export markets including Pakistan and Egypt means that the board has to be prudent with cash even as it considers expansion.

“Pakistan is on the verge of bankruptcy as a country. They buy a substantial proportion of our tea. Egypt has had a major devaluation of their currency last year and that means the tea is more expensive for them,” explained Dr McFie.

Dr McFie added that Sasini, which has been mechanising its tea-picking process, will retain a razor-sharp focus on cost containment to help boost profitability.

He said Sasini will be prudent with how it spends its operational funds but will invest where it has to, especially if the investment drives revenue and profit growth through efficiency, expansion and general improvement.

“Our automation work will continue in the factories and back offices to underpin the work already done in the fields on this aspect,” said Dr McFie.

Sasini is this year commissioning a 1.5 MW solar power generation station in its tea business to cut dependence on renewable sources of energy and also lower costs.

The firm says it will also enhance the efficiency of its fruit business by further investing in better storage extensions.

Sasini last year made a strategic decision to close down its dairy unit because it was draining money.

Mr Ochieng’ says the dairy business was way too small and production costs per litre of milk were above the selling price.

“When we closed it, a litre of milk was being produced at Sh32 a litre and we were selling at Sh30. That decision allows us to use that cash on other businesses. We are looking at several opportunities. It will be in new crops and general agriculture,” said Mr Ochieng’.

But even as the firm eyes expansion, the CEO said the board is not about to tinker with its long-standing philosophy of low appetite towards debt.

Mr Ochieng’ says that only if there will be an opportunity that exceeds the reserves will they consider going into debt.

The firm last year tapped an unsecured banking facility of $7.3 million (Sh908 million) from the Standard Chartered Bank Kenya and repaid it fully within the same trading period.

Sasini’s retained earnings hit Sh3.42 billion at the end of September last year, up from Sh2.53 billion a year earlier.